The average cost of a UK home has broken through the £250,000 barrier for the first time to stand at a record of £250,200.

Both the time taken to sell a home and the number of price reductions on properties have increased, according to our latest House Price Index.

While the rate at which property values are rising is likely to ease during the rest of the year, house prices are not expected to fall.

What’s happening to house prices?

House prices rose by 8.4% during the year to the end of April, slightly down from the annual rate of 9% recorded in March.

Property values edged ahead by just 0.2% during April itself, compared with monthly gains of 0.7% at the start of the year.

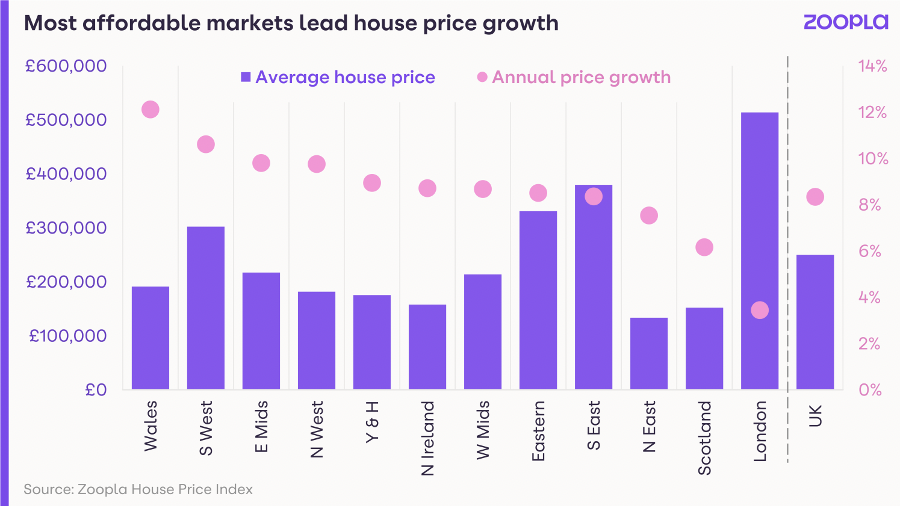

Wales saw the strongest price gains for the 15th consecutive month, with property values rising by 11.6%. Although this was down from the growth of 13% recorded in February.

Wales was followed by the South West at 10.5% and the East Midlands at 10.2%.

At the other end of the scale, London continued to lag behind other regions, posting growth of just 3.6%.

In terms of individual cities, those where property remains more affordable continue to see the strongest value gains.

Nottingham led the way with house prices increasing by 10% during the past year. It was followed by Liverpool at 9.9% and Bournemouth at 9.7%.

How busy is the market?

The housing market remains significantly busier than before the pandemic, but there are signs that activity is starting to slow.

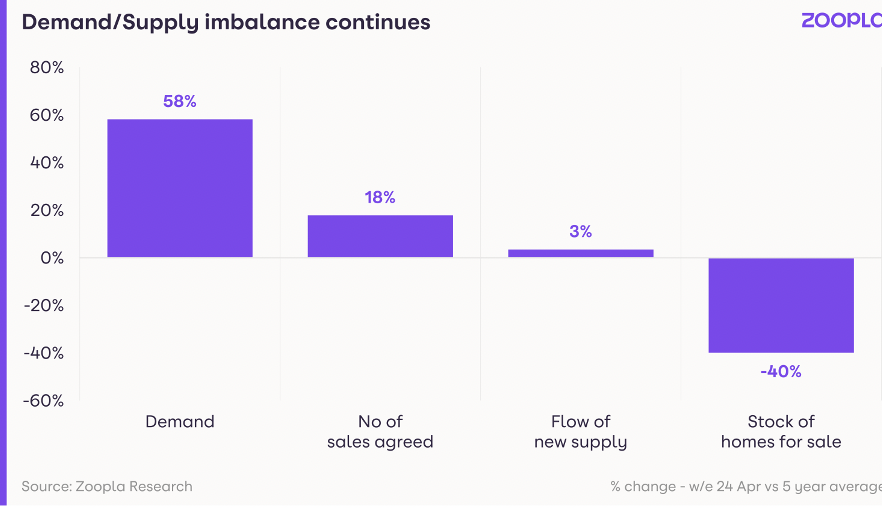

Demand continues to outweigh supply, with the number of potential buyers currently 61% higher than the five-year average. Meanwhile, the level of homes for sale is 37% lower than normal.

But the number of properties being put up for sale is beginning to increase. The number of new listings in the four weeks to 22 May were 7% higher than the five-year average.

Homes also took longer to sell than during the previous month for nearly all property types.

For example, a three-bedroom property outside of London is now taking an average of 18 days for a sale to be agreed. This was 16 days in March.

In London, three-bedroom homes are taking an average of 21 days to sell, up from 17 days previously.

At the same time, there has been an increase in the number of properties where sellers have reduced the asking price by at least 5%.

Since the second half of April, one in 20 properties listed has had a price reduction. This is compared with one in 22 in the previous 28 days. This is a pattern seen in every region of the country.

The average price reduction is 9%. For the typical house in the UK, this represents a discount of £22,500.

The North East has seen the highest number of homes that have been discounted by at least 5%, followed by the West Midlands.

What could this mean for you?

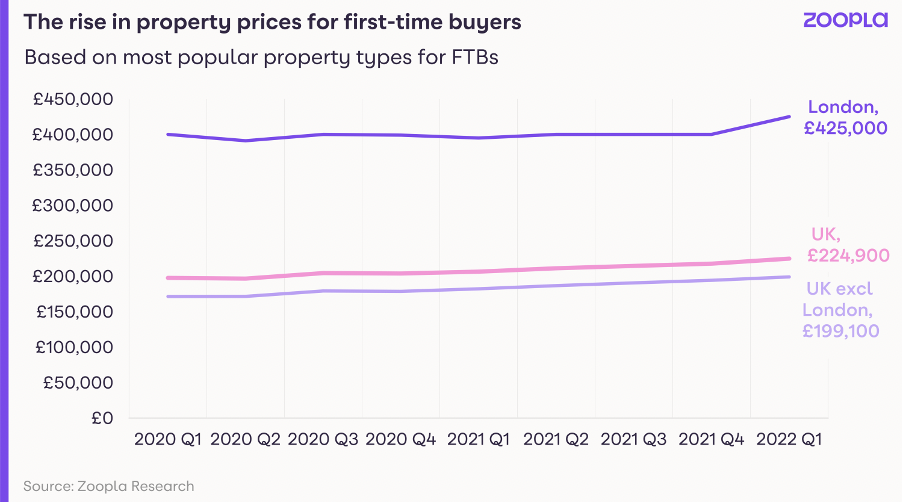

First-time buyers

The latest figures suggest the heat is starting to come out of the property market, which is good news for first-time buyers.

Sellers are showing signs of being more realistic about how much their home is worth, with one in 20 asking prices discounted by more than 5%.

Meanwhile, the number of properties being listed for sale is increasing, offering more choice to potential buyers.

Home-movers

After being a sellers’ market for some time due to the mismatch between supply and demand, the housing market now appears to be at a crossroads.

This is good news if you're looking to trade up the property ladder, as you'll have more choice. On top of this, sellers are also showing an increased willingness to reduce their asking price.

But you may also have to be less ambitious yourself in the amount that you list your current property for. You might have to be prepared to reduce your price if your home is not getting much interest.

Meanwhile, the fact that homes are taking slightly longer to go under offer suggests the market is less frenzied than previously. This should make it easier to co-ordinate your move if you are both a seller and a buyer.

What’s the outlook?

Recent strong house price gains, combined with higher interest rates and the rising cost of living, are expected to act as a brake on the market during the second half of the year.

Average monthly repayments for new mortgage customers have risen by £71 a month – the equivalent of £852 a year - since the start of the pandemic, based on a £175,000 mortgage.

At the same time, the average income needed to secure a mortgage on a £250,000 property has increased by £4,500 in the same period. This is assuming you put down a 30% deposit and borrow 4.5 times your income.

The current data suggests that pressure on people’s budgets, combined with other economic headwinds, is already affecting sentiment at the lower end of the housing market. Those with more disposable income are currently driving activity.

Going forward, this group is also likely to be influenced by the cloudier economic outlook later in the year.

The time taken to sell a home is already rising, and it is expected to increase further as demand from potential buyers starts to ease.

Meanwhile the number of homes being sold at a discount to their original asking price signals increased buyer resistance to higher property values.

This suggests that price growth may be hitting a natural ceiling.

Gráinne Gilmore, Head of Research at Zoopla, says:

“The annual rate of price growth will ease this year, on a monthly basis, price growth has already moderated."

"A continuation of this trend, even with some small monthly declines, means price growth will reach 3% by the end of the year.”

But she adds that Zoopla is not anticipating widespread house price falls.

“Given the number of homeowners on fixed-rate mortgages, which protect them against interest rate rises in the short to medium-term, the stress tests carried out on those loans, and the healthy employment market, we are not expecting a raft of forced sales in 2022, which is usually the trigger for price falls.”

Source; Zoopla

5 minute read posted by

5 minute read posted by

by

by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link